The increase in freight rates on the company’s long-term contracts will add about $10 billion to its revenue in 2022, compared with 2021, and this will more than offset an expected increase in bunker and other operational costs, company CEO Soren Skou said in a statement.

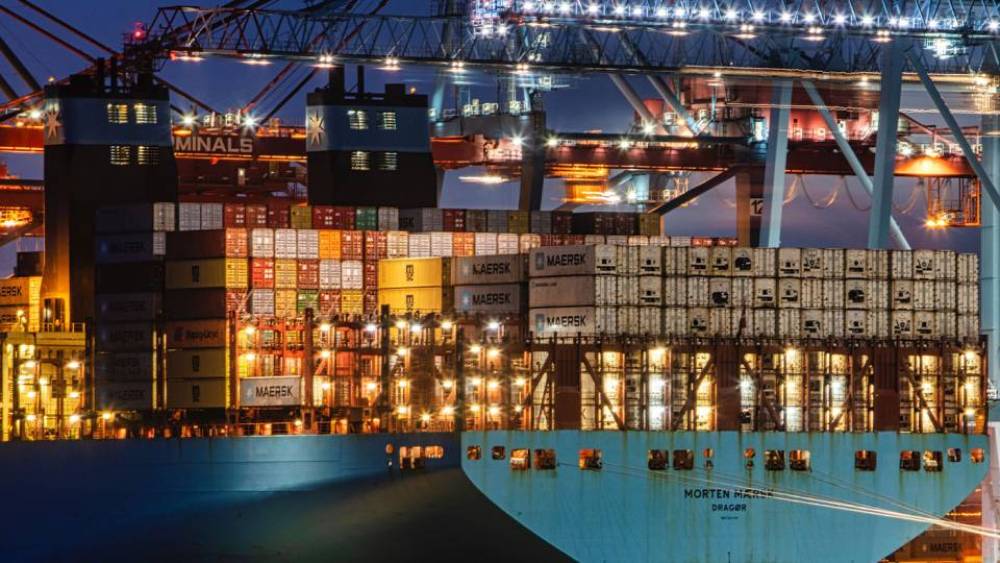

This trend was visible in Q1, amid congestion at ports and delays in cargo handling operations. Maersk’s average freight rate in Q1 was $4,553/FEU, up 71% on the year. This came as loaded volumes fell 6.7% on the year to 3 million FEU in Q1.

S&P Global Commodity Insight’s Platts container index averaged $6,755/FEU in Q1, up 54% on the year.

Maersk’s average bunker price increased 54% to $611/mt, partly offset by a 1.6% decrease in bunker consumption.

S&P Global assessed delivered 0.5%S fuel oil at Rotterdam at an average of $741/mt in Q1, up 63% on the year.

Looking ahead, the Ukraine-Russia conflict is dampening the demand outlook.

Russia’s invasion of Ukraine is weighing on trade flows and consumer confidence in Europe.

Against this backdrop, the change in global container demand is now expected to remain broadly stable, at between minus 1% and 1%, compared to earlier expectations of a 2-4% rise, Maersk said.

There are also headwinds from Asia. Capacity shortages continue to disrupt the supply-side of the logistics industry and trade flow growth from the Far East to both North America and Europe flattened, the company said.

“Restrictions in mainland China as a result of the zero-Covid tolerance policy will likely add further to network restrictions,” Maersk said in the statement.